Understanding Property Equity Crowdfunding.

GulfEstate implements a model called property equity crowdfunding, where multiple investors collectively fund the purchase of real estate properties. This approach enables participation in high-value investments with lower capital requirements, making property investing accessible without the need for substantial individual capital.

By pooling resources, investors acquire equity shares proportional to their contributions, benefiting from rental income and potential property appreciation. Through GulfEstate's property equity crowdfunding platform, investing in real estate becomes more inclusive, offering a transparent and efficient way to build a diversified property portfolio.

Understanding Key Real Estate Investment Terms.

Let's take a closer look at some essential terms and financial metrics that are important when analyzing real estate investments.

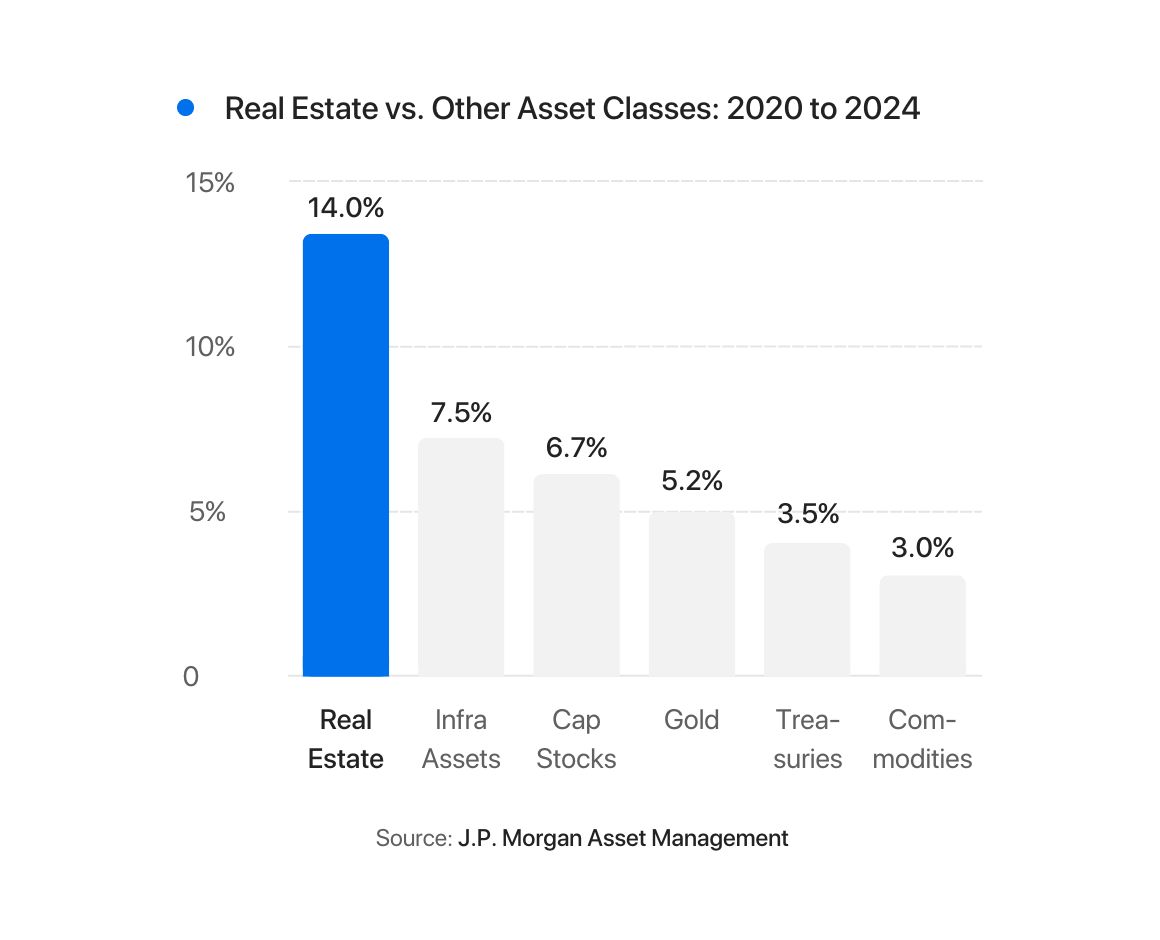

Real Estate

vs other asset classes

Investing in real estate offers unique benefits compared to other asset classes like stocks and bonds. Real estate provides both steady rental income and the potential for long-term capital appreciation. This combination enhances overall returns and adds stability to an investment portfolio. Additionally, real estate often exhibits lower volatility compared to financial markets, serving as a hedge against economic fluctuations.

However, traditional real estate investing can involve high entry costs, lack of liquidity, and the complexities of property management. These challenges can deter investors seeking to capitalize on real estate opportunities. GulfEstate mitigates these downsides through our property equity crowdfunding model.

Real estate offers consistent rental income alongside potential property value appreciation, enhancing returns on investment.

Risk MitigationIncluding real estate can reduce overall investment risk due to its low correlation with other asset classes.

GulfEstate's Investment Strategies

Our approach is rooted in thorough market analysis and strategic property selection, ensuring that each investment aligns with our commitment to excellence and profitability.

a. Capital Appreciation

Our strategy involves identifying properties with significant potential for value growth over time through in-depth research into various factors poised to drive future price growth.

b. Long-Term Rentals

We select properties in established neighborhoods with strong rental demand and reliable occupancy rates. This approach provides consistent rental income and steady cash flow.

c. Short-Term Rentals

Capitalizing on the growing demand for flexible accommodation, we invest in properties suitable for short-term rentals. Located in popular tourist destinations and business hubs.

d. Renovation Projects

We identify undervalued properties with the potential for significant value enhancement through renovations. By upgrading and modernizing these properties, we increase their market appeal and rental potential.

Investment Selection Process

At GulfEstate, we use a systematic approach to select properties that align with our investment strategies. Through thorough market analysis, we identify properties with strong potential for growth and profitability, ensuring optimal returns for our investors.

Market Research & Analysis

Using comprehensive research, we analyze economic indicators and demographic trends to identify high-growth markets. We leverage technologies like machine learning to forecast market trends accurately, helping us stay ahead and find opportunities aligned with our goals.

Financial Projections

We create detailed financial projections to assess each investment's viability, forecasting rental income, expenses, and expected appreciation. These data-driven models provide clear performance expectations, informing our strategies and supporting our goal of maximizing profitability.

Risk Mitigation

Investing in real estate carries inherent risks, but at GulfEstate, we are dedicated to minimising these risks through strategic measures and robust safeguards.

Building a Balanced Portfolio

We offer our investors the ability to build strong, diversified portfolios through our equity property crowdfunding model. By investing in a variety of property types and locations, investors can spread risk and capitalize on different market opportunities. This diversification helps mitigate the impact of any single property's performance and contributes to more consistent overall returns.

Professional Management and Oversight

Properties acquired through GulfEstate benefit from professional management services. Experienced property managers handle day-to-day operations, tenant relations, and maintenance, ensuring optimal performance. Additionally, GulfEstate provides ongoing oversight and transparent reporting, keeping you informed and allowing for proactive risk management.

Enhanced Liquidity

Understanding that investment needs can change, GulfEstate provides flexible exit options. Whether through scheduled liquidity events, buy-back provisions, or a secondary market platform for selling your stake. This flexibility reduces the risk associated with long-term capital commitments and allows you to manage your portfolio in response to personal financial goals or market conditions.

Why Invest In Dubai

A Top-Tier GulfEstate Pick.

Our comprehensive analysis, leveraging data from leading financial sources and market insights, showcases real estate as a standout investment for 2024.

Best Rental Yields

Dubai currently offers some of the highest rental returns globally, providing investors with strong and steady income streams.

Tax-Friendly Enviroment

Benefit from Dubai's tax-efficient environment, with no property taxes or capital gains taxes on real estate investments.

High Investment Returns

Dubai consistently offers attractive rental yields and strong capital appreciation, making it a hotspot for investors seeking robust returns.

World-Class Infrastructure

Continuous investment in cutting-edge infrastructure enhances property values and attracts global businesses and talent.

Strategic Global Hub

Dubai's prime geographical location connects East and West, making it a central hub for international business and travel.

Invest With GulfEstate, A Smart Choice.

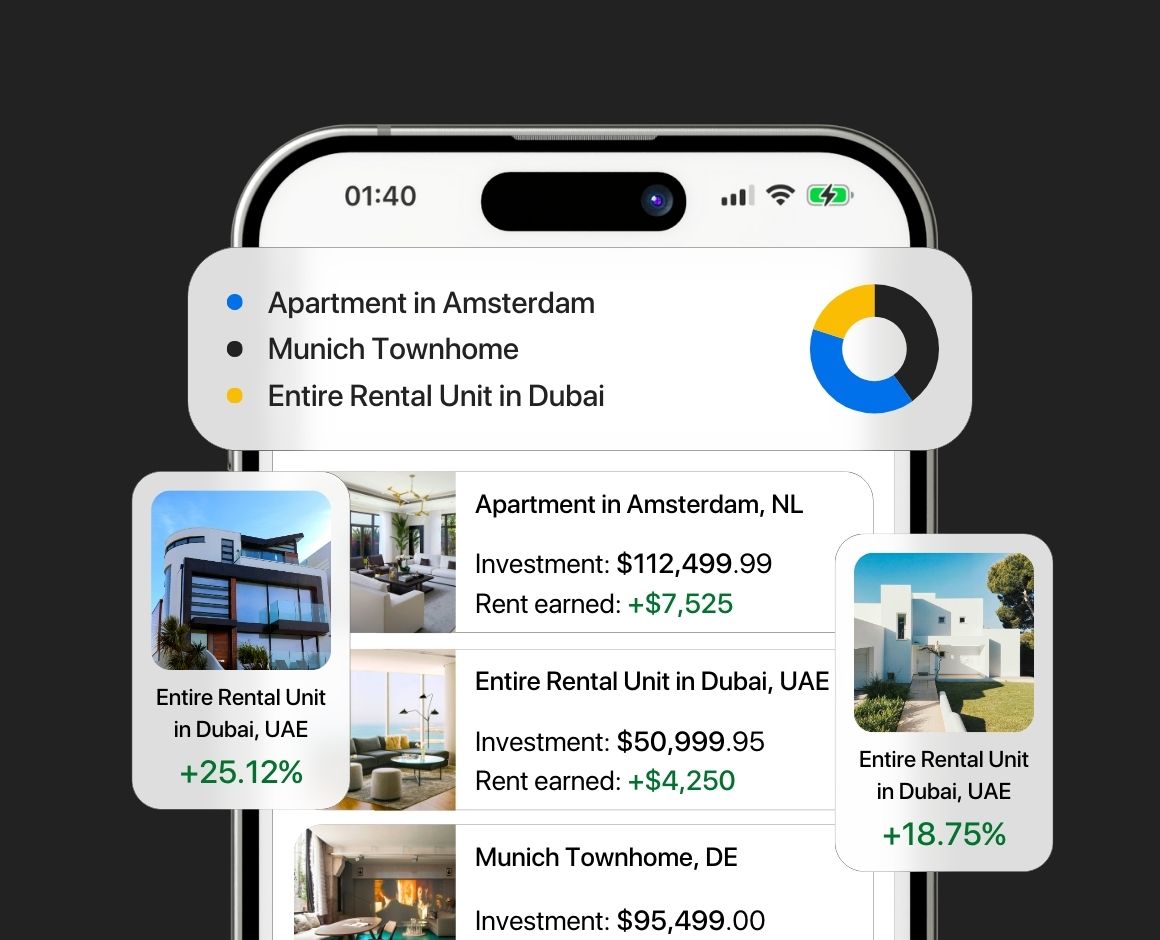

Discover a smarter way to invest in real estate with GulfEstate. Our user-friendly

platform connects you to lucrative rental properties, combining the tangible

benefits of real estate with modern investment convenience.

GulfEstate provides an

efficient path to growing your wealth through property investing.

What If You Allocated 5% Of Your Portfolio To Real Estate?

Start InvestingFrequently Asked Questions

GulfEstate is a real estate crowdfunding

platform.

We acquire and manage real estate assets, allowing clients to invest

in them to earn passive rental income and potential capital appreciation when

the properties are sold.

Those seeking to build long-term wealth and financial safety nets benefitting from the stability and historic performance of real estate with the additional diversification offered by GulfEstate's global opportunities.

GulfEstate's investment properties are selected using a thorough evaluation

process.

We leverage real estate market expertise along with advanced data analysis to

identify potential opportunities.

Each property then undergoes physical inspections and financial forecasting to

estimate costs, rental income, and potential appreciation.

Only properties that meet our criteria across all assessments are approved for

acquisition and offered as investment options.

Yes, all investment opportunities available through GulfEstate are exclusively

designed for long-term investing.

We do not offer any short-term options.

Our platform is tailored for investors who understand the benefits of holding

real estate investments over an extended period.

This long-term approach allows investors to maximize potential returns and

benefit from the stability and growth associated with carefully selected real

estate assets.

We make investing easier than ever.

Simply sign up to our platform and explore the available properties, then

complete a quick KYC process to verify your identity.

After that you are all set, start investing from as little as $150 USD, track

your portfolio in real-time and receive periodic passive income and price

appreciation.